City votes to raise rents for thousands

The Rent Guidelines Board, the city regulatory agency that decides the prices of rent-stabilized units, preliminarily voted to increase rents in their largest single-year jump in nearly 10 years. The final vote will be held on June 21.

The RGB voted to increase rents by 2-4 percent for one-year leases and 4-6 percent for two-year leases in a 5-4 vote on Thursday. The last time the RGB raised rents by over 3 percent was in 2014; that year one-year leases increased by 4 percent while two-year leases increased by 7.75 percent.

A 2017 report from the Housing and Preservation Department found that Brooklyn comprises nearly 30 percent of the city’s rent-stabilized units; meaning that up to nearly 275,000 units in Kings County could be facing increases.

The jump in rents marks a shift from the freezes and modest increases the RGB pursued under previous Mayor DeBlasio’s more tenant-friendly board. Mayor Adams appointed a landlord lawyer and a self-proclaimed rent control skeptic to the board last month, as City Limits reported.

The RGB is comprised of nine different members who are all appointed by the mayor. Two seats are designated for tenant interests, two others to represent owners, while the other five are supposed to represent the general public.

“Inflation is hurting property owners as the cost of providing safe, clean, affordable housing continues to rise. Our analysis of the data is that an increase of rents it keeps up with inflation and rising property taxes is necessary to protect the housing stock,” said Robert Ehlrich, one of the owner representatives. Ehrlich continued to cite RGB research that found that 1/3 of rent-stabilized buildings are spending 70 percent of operating income on costs.

Sheila Garcia, one of the tenant representatives called for rent freezes and rent rollbacks on apartments.

“This is what the language of the statute reads. action is necessary to prevent exactions of unjust, unreasonable, and oppressive rents and rental agreements. And to forestall profiteering speculation and other disruptive practices tending to produce threats to the public health, safety, and general welfare. It goes on to say that this is because many, many owners, and I quote, ‘were demanding exorbitant and unconscionable rent increases.’ These are the underpinnings of why the RGB exists,” said Adán Soltren, the other tenant member of the board.

The New York City Council Progressive Caucus, which represents the majority of the council, denounced the rent hikes in a statement.

“We are at a loss as to why the recommended increases only have the landlord in mind, devised so as to maintain landlords’ net operating income at constant levels. Why should the maintenance of landlord income be privileged over the tenants’ ability to keep up with cost of living increases? Tenants have not experienced wage or salary increases of 9%, are paying more for everything due to inflation, and unemployment in the City remains nearly double the national average,” the statement reads.

The caucus also called for an immediate rent rollback to stave off evictions and that the board hold at least five public hearings, one in each borough. There are only two scheduled public hearings before the final vote in June, currently scheduled on the RGB website.

Mayor Adams, who is a landlord himself, refused to take a stance on the floated hike in order to maintain the independence on the board. Adams emphasized the responsibility of his appointed positions to strike the balance between landlords and what Mayor Adams described as small time renters.

The progressive caucus dismissed the notion of ‘mom-and-pop’ landlords being the primary provider of rent-regulated apartments. Their statement cited a 2017 analysis of Housing Preservation and Development data released by Justfix.nyc, a non profit organization that releases online tools for the housing movement. The report found that 91 percent of “mom-and-pop” landlords, defined as only owning one building by the Progressive Caucasus, do not own buildings with rent-regulated units and that 70 percent of landlords who own rent-regulated units own six or more buildings.

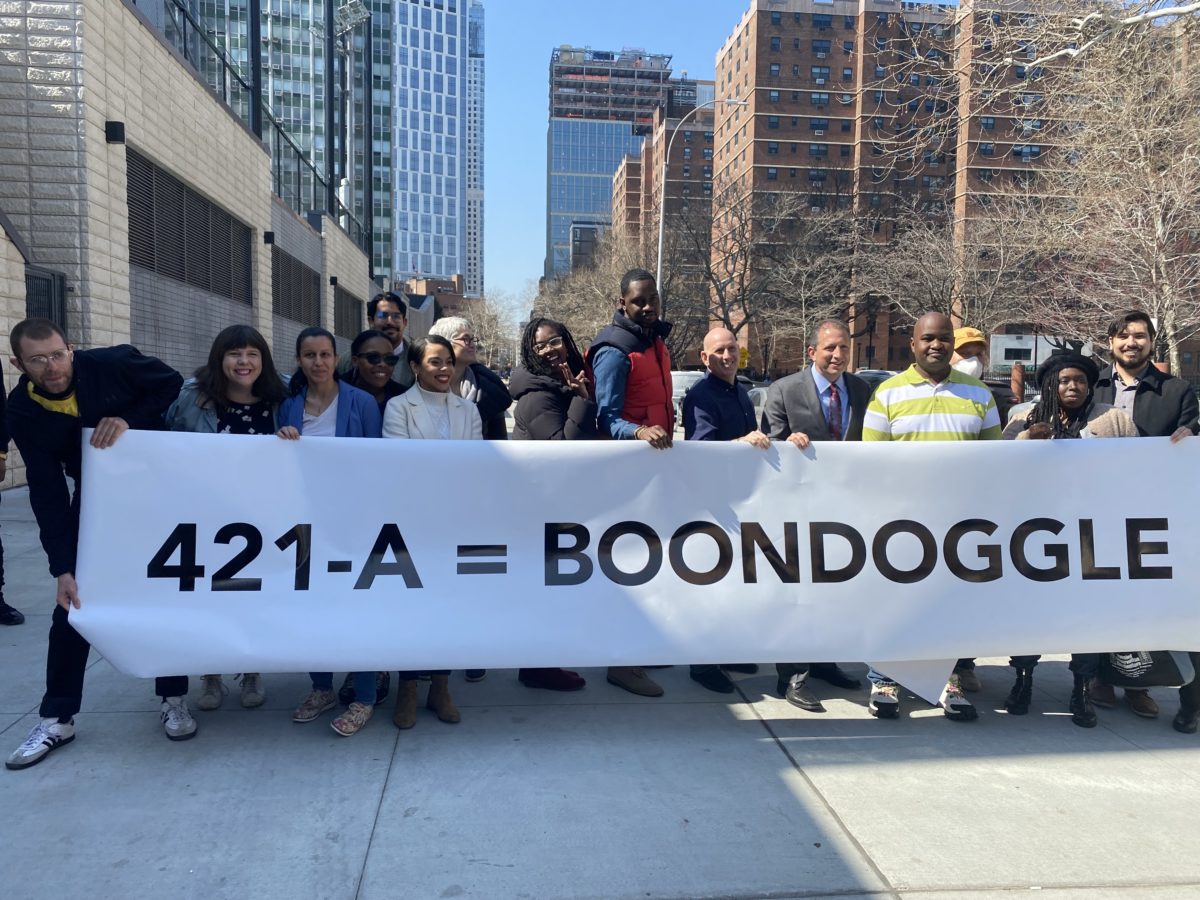

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.