ALICE D. NOEBEL

Alice D. Noebel passed away on Wednesday, February 16, 2022 at the age of 87. Beloved Wife of the late George F Noebel. Loving Mother of Susan Provan and Thomas Noebel, and mother-in-law of Ian and Kathleen. Cherished Grandmother of Robert, Emma, Thomas and Daniel and Great-Grandmother of Kai and Stella. Mass of Christian Burial offered at Transfiguration Church on Saturday February 19, 2022 9:30 AM. Interment followed at St. John Cemetery, Middle Village, NY under the direction of Papavero Funeral Home, 72-27 Grand Avenue, Maspeth NY 11378.

IRMA VAZQUEZ

Irma Vazquez passed away on Friday, February 11, 2022 at the age of 64. Beloved Mother of Rosa Garcia, Denise (Guillermo) Ramirez, Wanda Ramirez and Rick Ramirez. Cherish Grandmother of Harley, Gonzalo, Jorge and Izel. Private Cremation held on Tuesday, February 15, 2022 at All Souls Crematory, East Elmhurst, NY. Memorial Visitation held at Papavero Funeral Home on Sunday, February 20, 2022 from 3-5 PM under the direction of Papavero Funeral Home, 72-27 Grand Avenue, Maspeth NY 11378.

ELEANOR ZAINO

Eleanor Zaino passed away on Saturday, February 12, 2022 at the age of 86. Beloved Sister of Janet Zaino. Loving Daughter of the late Dr. Felix & Anne Zaino. Dear Cousin. Graveside Funeral Service offered on Friday, February 18, 2022 at St. John Cemetery, Middle Village, NY under the direction of Papavero Funeral Home, 72-27 Grand Avenue, Maspeth NY 11378.

GREGORY T. GABRIEL

McGuinness’s taps into spirit of St. Paddy’s Day

Even a muggy St. Patrick’s day couldn’t keep Sunnyside regulars out of McGuinness’s Saloon.

Local bar-goers enjoy a pint

At the corner of Queens Boulevard and 45th place sits McGuiness’s – a tiny hole-in-the-wall Irish joint. The place was well decorated for the festivities. Green Christmas lights were strewn across the premises, corned beef was served at the typically drinks-only bar and bountiful irish accents drowned out the traditional music playing in the background. The men’s room is to the left of the bar, as a sign clearly denotes, “Men to the left ‘cos women are always RIGHT.”

When you walk into the bar, the first chair is typically occupied by Séan Gorham. For the 25 years McGuinness’s has been open, he has been sitting in that same seat.

When asked why this was his favorite bar Gorman simply said “because it was across the street” before giving his serious answer. It’s because Marie McGuinness makes everybody feel comfortable.

McGuinness immigrated to this country from Donegal in 1987 and moved out to Queens with her husband Brandon McGuinness in 1990. They had worked in the service and bar industry priorly and had always wanted to open a place of their own together. Brandon passed away in 1996, just under a year before the bar that is his namesake opened.

Marie McGuiness wearing green for St. Patrick’s Day

While that bar has its fair share of clientele from Ireland, Marie McGuiness described her customers as “the league of nations” and speculated that even though it was St Patricks Day, the bar had about 20 people from different countries in there.

“I want customers to feel that this is their home away from home – no matter what country in the world they’re from. We have the best bartenders in the world. I want every customer to feel welcomed. If I go into a bar, whether it’s in any country, I would want to feel as welcome as people would make feel here. I always say a woman should be able to walk into any bar alone, set up at the bar, and chat to the bartender about sports or whatever,” McGuinness said.

And the approach has worked.

During the Covid-19 pandemic, Marie struggled to keep the bar afloat. The restrictions placed financial stress on her business but as soon as the options for outdoor dining opened, her crew of regulars sat outside every weekend, even in the snow and crummy weather, in order to help support their favorite bar.

Joe Mennicucci has been regular with his with Kim Hirsch for as long as they can remember. He agrees with McGuiness about the bartenders being the best in the world. Before there were cell phones, he used to pay the bartender five to ten bucks every time the bartender would tell Mennicucci’s wife that every time she called that he wasn’t at the bar.

“It’s been open 25 years since February 13,” McGuinness said. “Hopefully, it will be open another 25 years, I’ll be walking around with my cane.”

City’s New Top Doctor gives COVID briefing

Dr. Ashwin Vasan has taken over as the city’s top doctor at the two-year mark of the ongoing pandemic.

Officially taking the reins from Dr. Dave Chokshi on March 16, Vasan held his first briefing last week in Queens alongside President and CEO of NYC Health + Hospitals, Dr. Mitchell Katz and Director of NYC Test and Trace Corps, Dr. Ted Long.

“Although it’s only my first week on the job, I understand how important regular communication is with all of you,” Vasan said to the press. “While the losses of the last two years have been profound, we’ve also developed tools in that period that are saving lives, including testing, prevention and new treatments, like antiviral pills.”

“It’s an honor to be the city’s doctor. Something you’ll hear me talk a lot about is the emotional toll that this pandemic has taken on all of us. We have all been through so much over these past two years and continuing uncertainty about the future of COVID can certainly add to the strain on New Yorkers mental health and well being,” Vasan said.

As of March 21, the city’s seven-day and 28-day average positivity rates are trending in the right direction with 1.66 percent and 1.89 percent rates, respectively.

Although he said New York City is currently in a “low-risk environment”, Vasan said he and his team at the city’s Department of Health and Mental Hygiene is monitoring the presence of the BA.2 subvariant of Omicron.

Dr. Celia Quinn said that ‘about 30 percent’ of cases in the city can be attributed to the subvariant, and that while it appears to be more transmissible than other strains of Omicron, it does not appear to cause more severe illness.

“I think the important thing to remember and to emphasize for New Yorkers is that currently, there’s no evidence that BA.2 causes more severe illness, increases risk of hospitalization, or that our current vaccines offer less protection against it,” Vasan said.

With just 55 percent of New Yorkers aged 65 or older who received their booster or additional dose, Vasan and his team stressed the importance of vaccines and reconnecting with health care providers.

As some mask mandates have been relaxed in city schools and other places, Vasan and Katz hesitated to say what it would take to lift a workplace vaccine mandate.

“People who have tried to predict what’s going to happen in the future for this pandemic have repeatedly found egg on their face, as they say, and I’m not going to do that here today,” he said.

Dr. Katz added, “Nobody has suggested that we should, you know, because polio levels are so low, we should say that schoolchildren shouldn’t be vaccinated for polio. I think vaccine mandates have a long and important history in public health.

“If you have childhood vaccinations, then everybody grows up to be vaccinated. So it turns out to be irrelevant, right? The point of childhood vaccinations is by doing it at childhood, you’re giving the person maximum benefit. And then they grow up as a whole cohort of people who are fully vaccinated.”

Astoria Starbucks first in Queens to file to unionize

An Astoria Starbucks is filing for a union, the first of its kind in Queens.

The store, located at 30-18 Astoria Boulevard, announced its plans to file a petition for a union election in a letter written to President and CEO Howard Schultz.

“The organizing committee at Astoria Blvd. firmly stands in solidarity with unionization efforts across the country,” the letter reads. “The same courage of stores before us has empowered our baristas to take positive action. We are cautiously excited for the future of a company that is reflective of its workforce and not of corporate greed.”

The Astoria location is part of more than 145 stores across the country that have filed to unionize.

The Astoria location is part of more than 145 stores across the country that have filed to unionize.

Elected officials at all levels of government showed their support for the workers at the Astoria Boulevard store with a letter of support and impromptu visits to the store.

Rep. Carolyn Maloney, State Senator Michael Gianaris, Assemblymember Zohran Mamdani and Councilmember Tiffany Cabán all signed on to the letter calling for Schultz to sign the Fair Election Principles and respecting the workers’ right to organize.

“Every worker should have the right to organize a union and bargain collectively,” Gianaris said. “I stand with the workers at my local store and the entire Starbucks Workers United effort as they fight for better working conditions and fair pay for all associates. I call on Starbucks to allow the free, unencumbered election these workers deserve.”

In February, three Starbucks locations in New York City made their first efforts to unionize, just weeks after three more stores in Buffalo were the first to do so. The first union elections in New York City will be an in-person vote at the Roastery at the end of the month.

The Astor Place location will be voting by mail with ballots going out at the start of next month, and ballots for Caesar’s Bay in Brooklyn, Great Neck in Long Island, and Massapequa in Long Island will go out a week later.

Brandi Aldu, a Starbucks Workers United organizing committee member, said, “My fellow partners and I decided to unionize because we are forced to manage the consequences of decisions we were not a part of, made by people who don’t understand what it is like to live a life as a Starbucks barista.”

Two-alarm fire on Grand Avenue in Maspeth

FDNY responded to a two-alarm fire along Grand Avenue in Maspeth, on March 16, which left three injured.

The blaze broke out around 10 a.m. inside the three-story commercial building at 65-50 Grand Avenue spreading from Lafyes Jewelry store.

The blaze broke out around 10 a.m. inside the three-story commercial building at 65-50 Grand Avenue spreading from Lafyes Jewelry store.

Twenty-five units were dispatched to fight the blaze, and more than 100 firefighters and EMS were at the scene. FDNY were able to have the fire under control around 11:30 a.m.

According to an FDNY spokesperson, two civilians and one firefighter were injured and transported to Elmhurst Hospital Center.

The cause of the fire is currently under investigation.

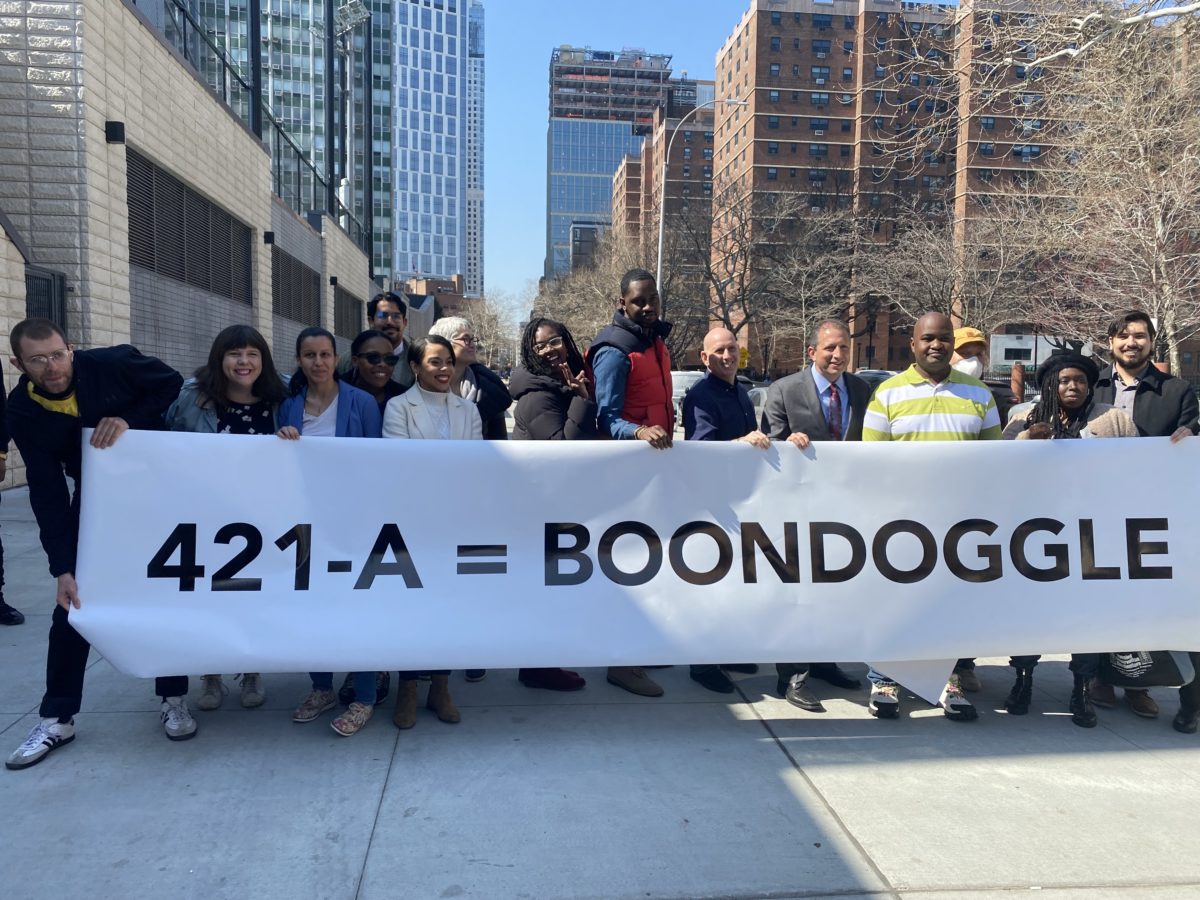

Progressives call for the end of 421-a

Progressive politicians have a new rallying cry: “421-a , let it die!”

The little-known abbreviation is a major property tax break for developers that is set to expire this summer – and the left wants to keep it that way. The 421-a tax program was created in 1971 to spurn investment when the city was lacking money. But critics now see it as an antiquated piece of legislation that gives tax breaks for developers while failing to achieve affordable housing.

Under 421-a, developers can receive tax breaks for building housing that is determined affordable at 130 percent of the average median income. In areas like Williamsburg, that means that a single adult making over $100,000 could qualify for affordable housing.

Councilwomen Tiffany Cabán and Pierina Sanchez introduced a resolution to urge the state legislature and Governor to allow the program to expire while Comptroller Brad Lander released an analysis of the 421-a that recommended its lapse and for structural property tax reform to replace it.

New York State Assemblywoman Emily Gallagher has also introduced legislation, that is currently in committee, that would give the state the power to audit potential overcharging of rents in 421-a buildings.

“421-a is not an affordable housing strategy, it’s free billions for developers. At a time when we have so many people desperately in need of vital assistance, we have absolutely got to stop this massive giveaway to the wealthy real estate interests who need it least,” Cabán said.

In recent months, Governor Hochul has proposed a new version of 421-a, called 485-w, that would make modest changes to the affordability requirements and wages for construction workers.

“Governor Hochul’s proposal was offensive: plain and simple. It’s tweaking, in the most minor and modest ways, a program that is fundamentally broken. We need to end 421-a; we need to go back to the drawing board,” Councilman Lincoln Restler said. “ We need to start investing in housing that’s going to end the homelessness crisis that’s going to make sure that each and every family in our community can afford to stay and live in our community.”

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.

The comptrollers report found that this year the city will give up $1.77 billion in 421-a tax breaks while the city comparatively spends 1.1 billion on the city’s Department of Housing Preservation and Development.

“So all the money the city intentionally spends on affordable housing for a wide range of people – folks who have been homeless or folks who are getting a first rung on the homeownership ladder. The whole array of HPD programs is less than we give away in 421-a tax breaks tax breaks,” Lander said.

Lander’s report features a proposal for property tax reform that would replace the 421-a program while still creating incentives for developers to build affordable housing. It includes creating a new targeted affordable housing tax incentive to build true affordability, equalize tax treatment between residential construction, and also introduce a revenue-neutral tax rate for family homes, small rental buildings as well as condos and co-ops.

The 421-a tax program is set to expire June 15th of this year and the proposed deadline for structural tax reform laid out in Lander’s plan would be in the winter of this year.